-

Europe can both reach an ambitious 2040 climate target and grow its economy.

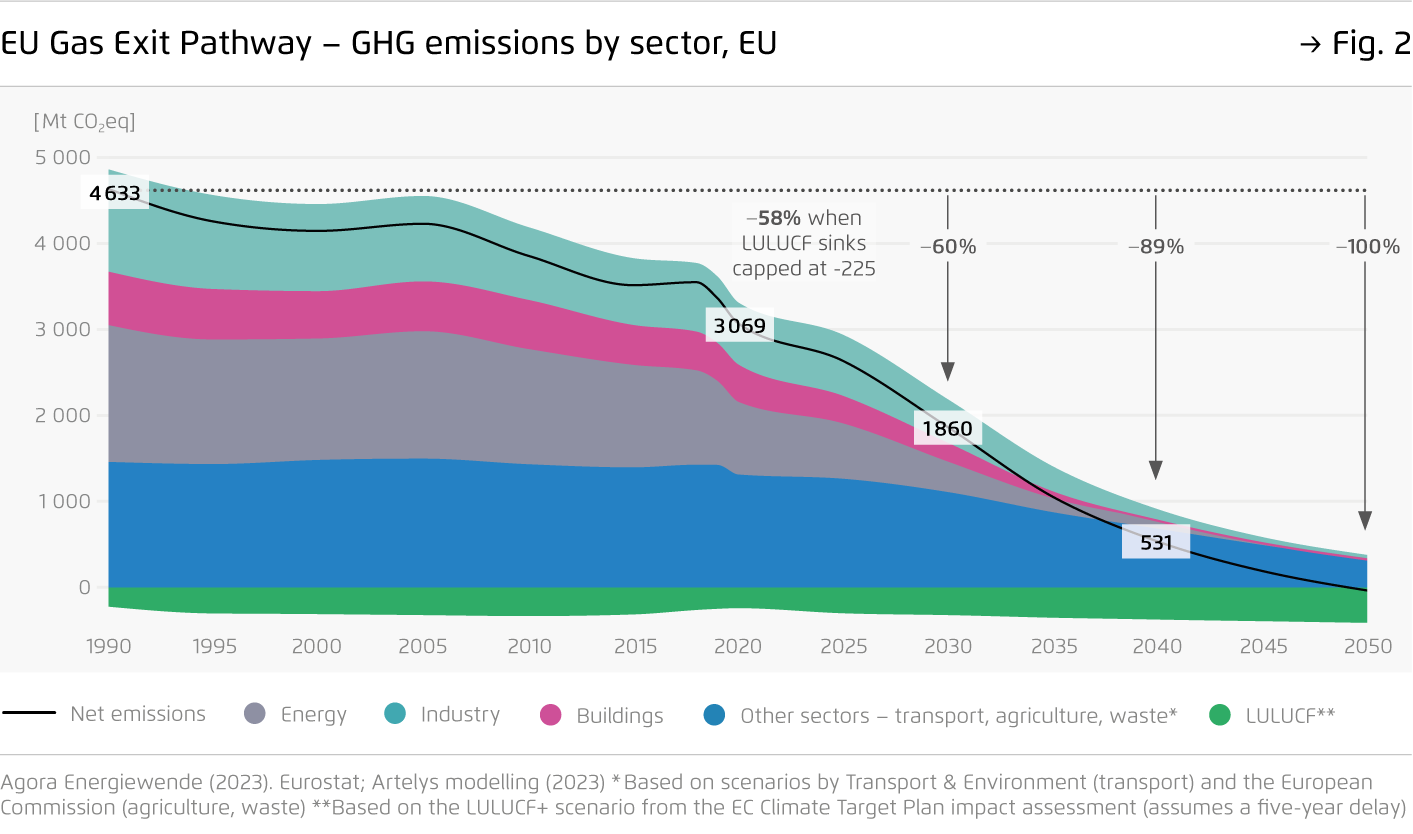

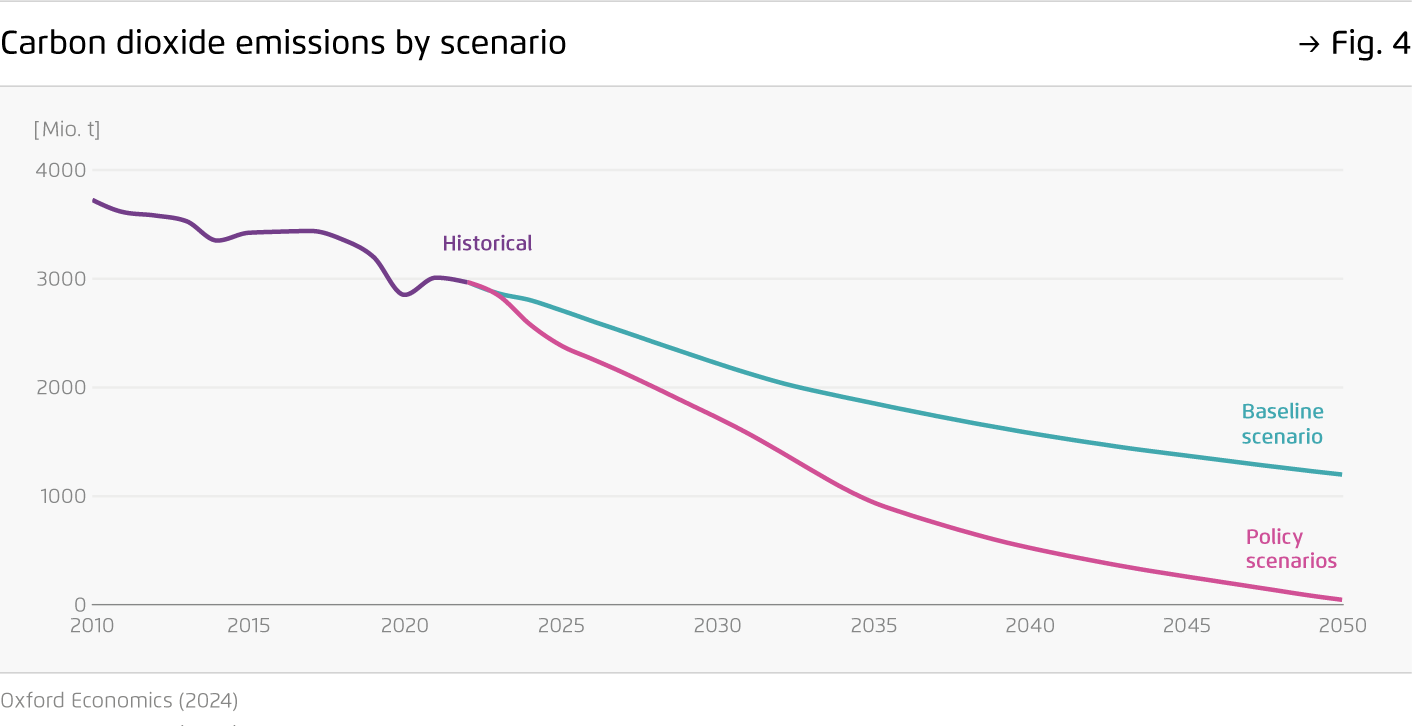

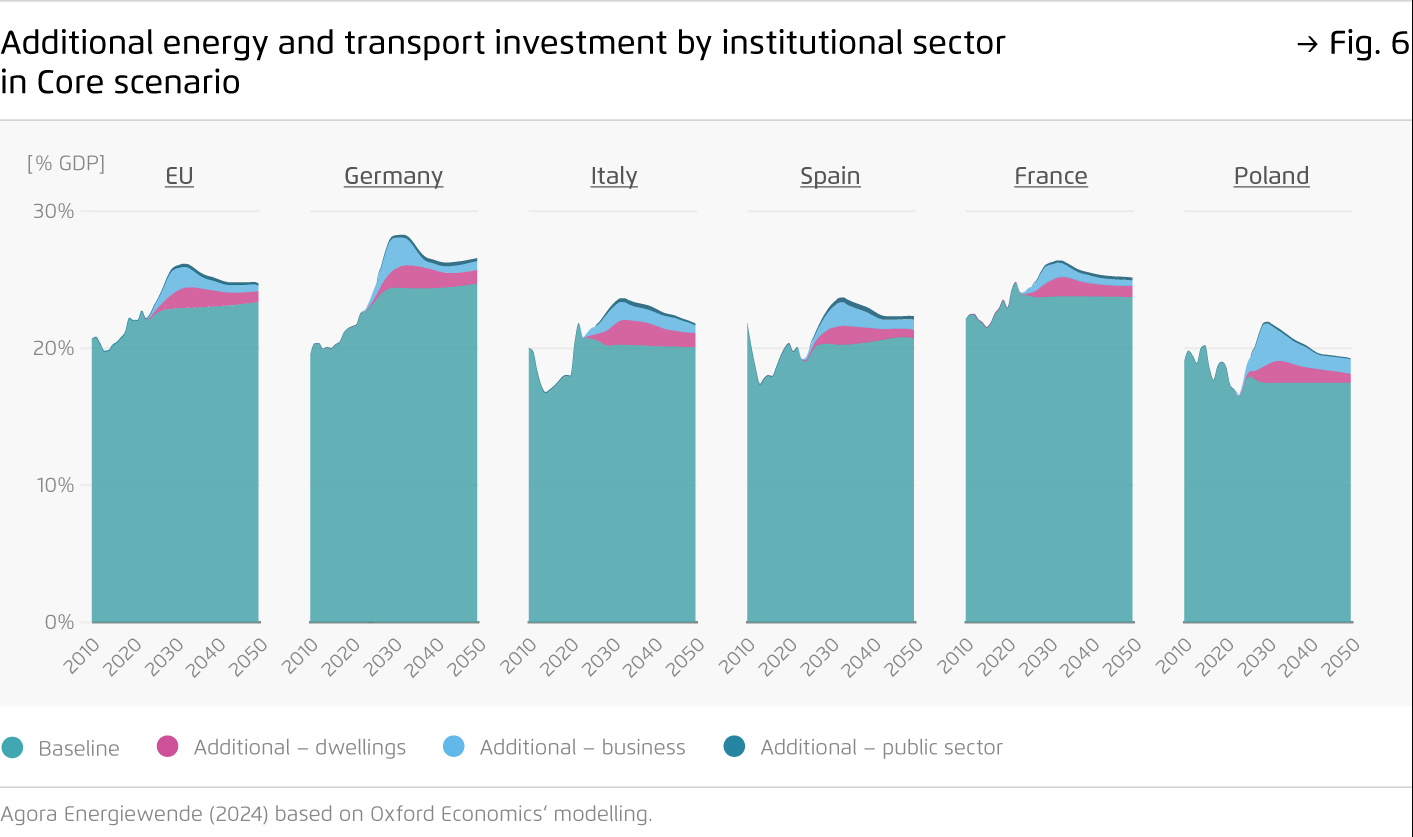

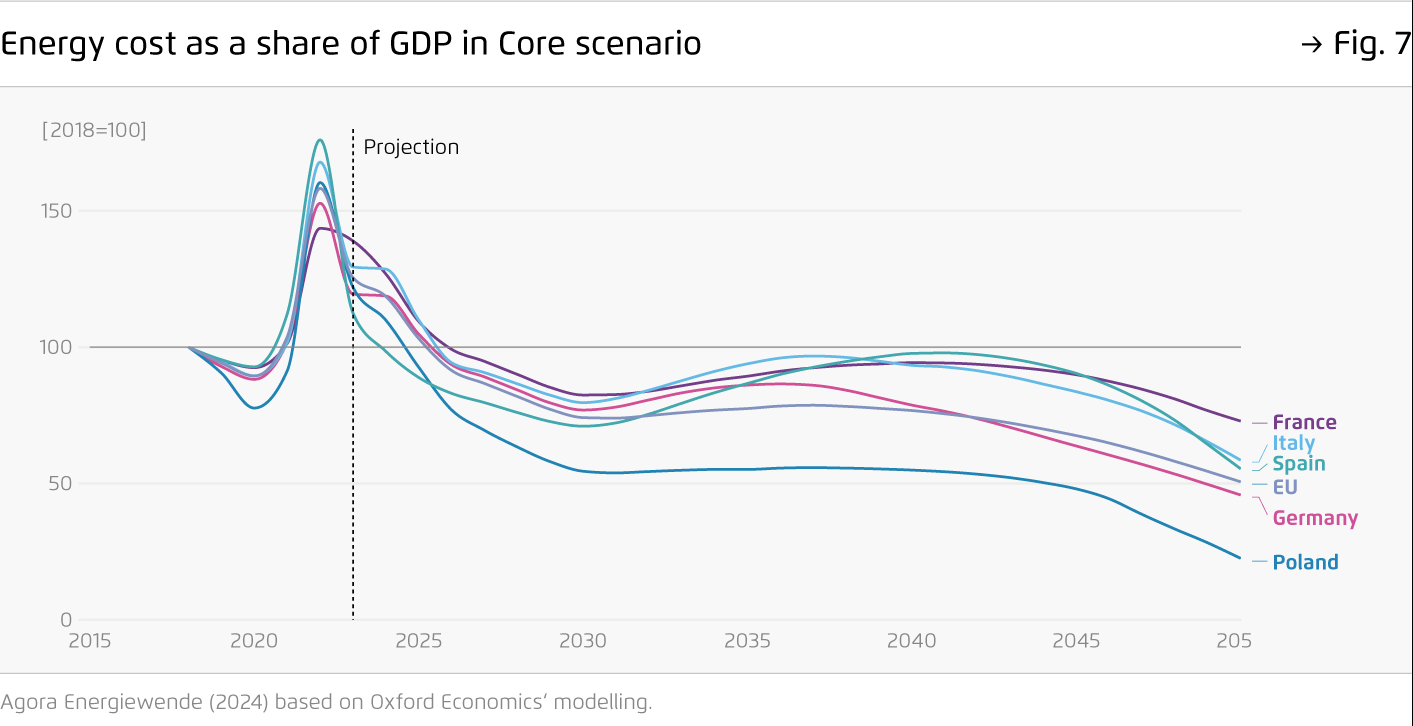

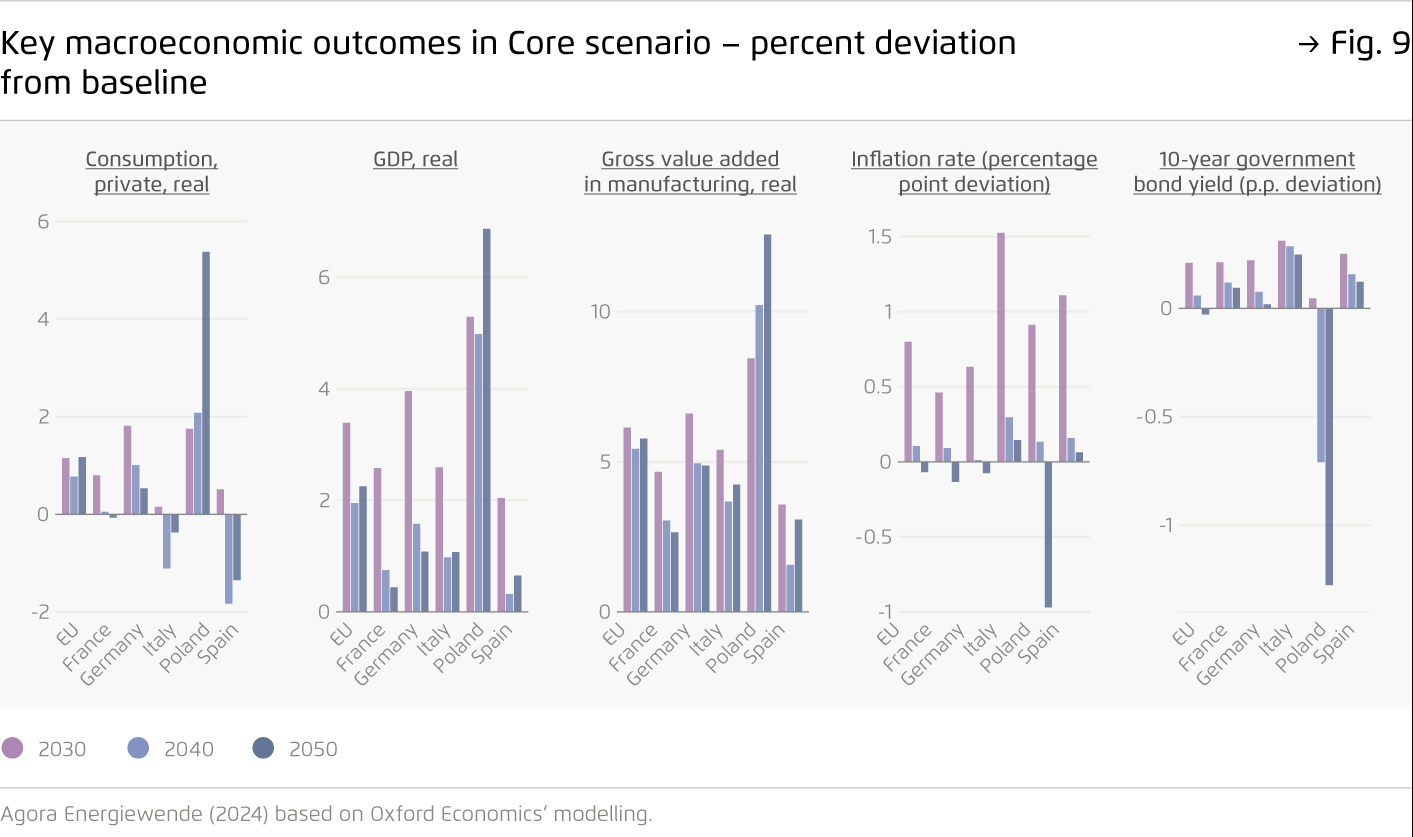

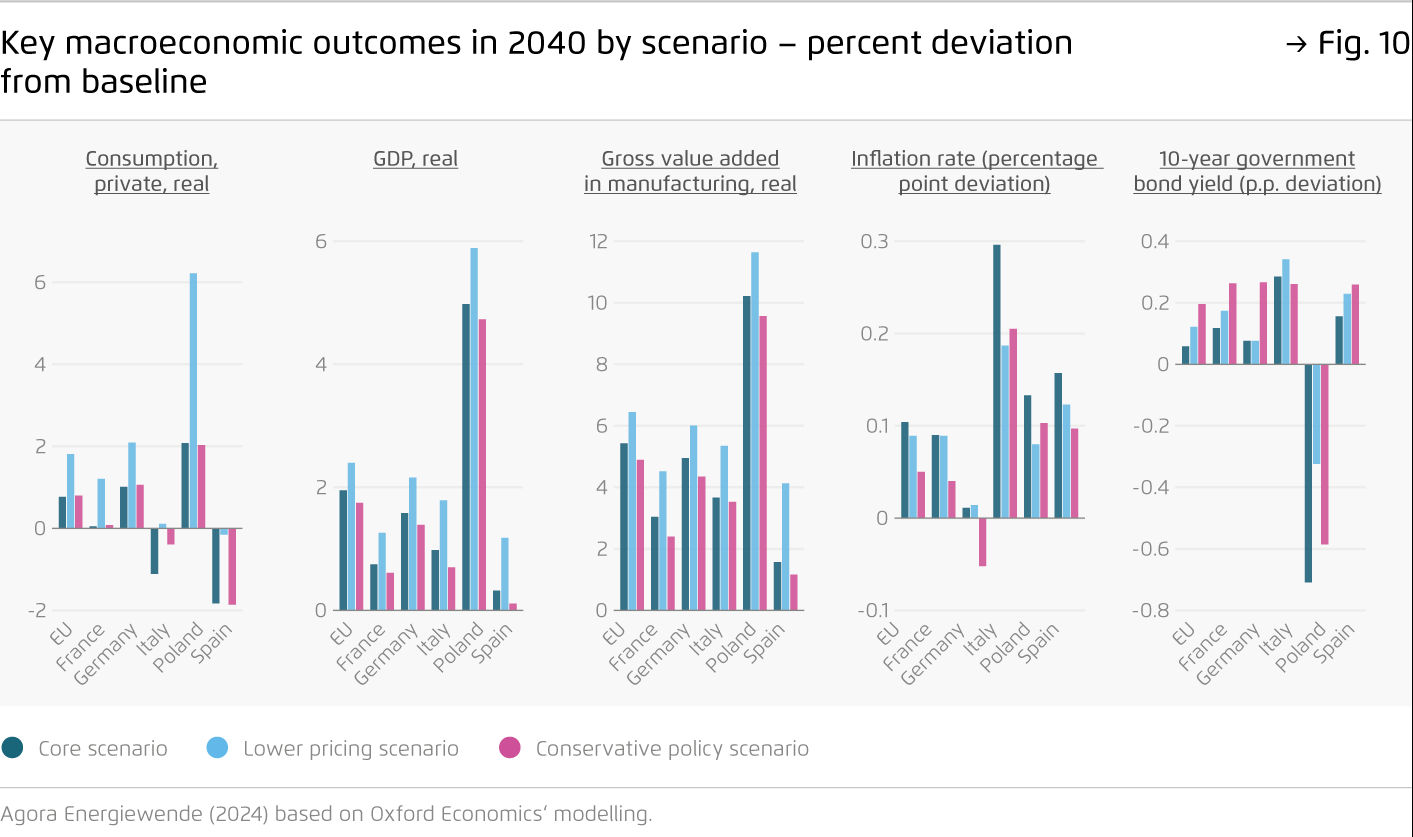

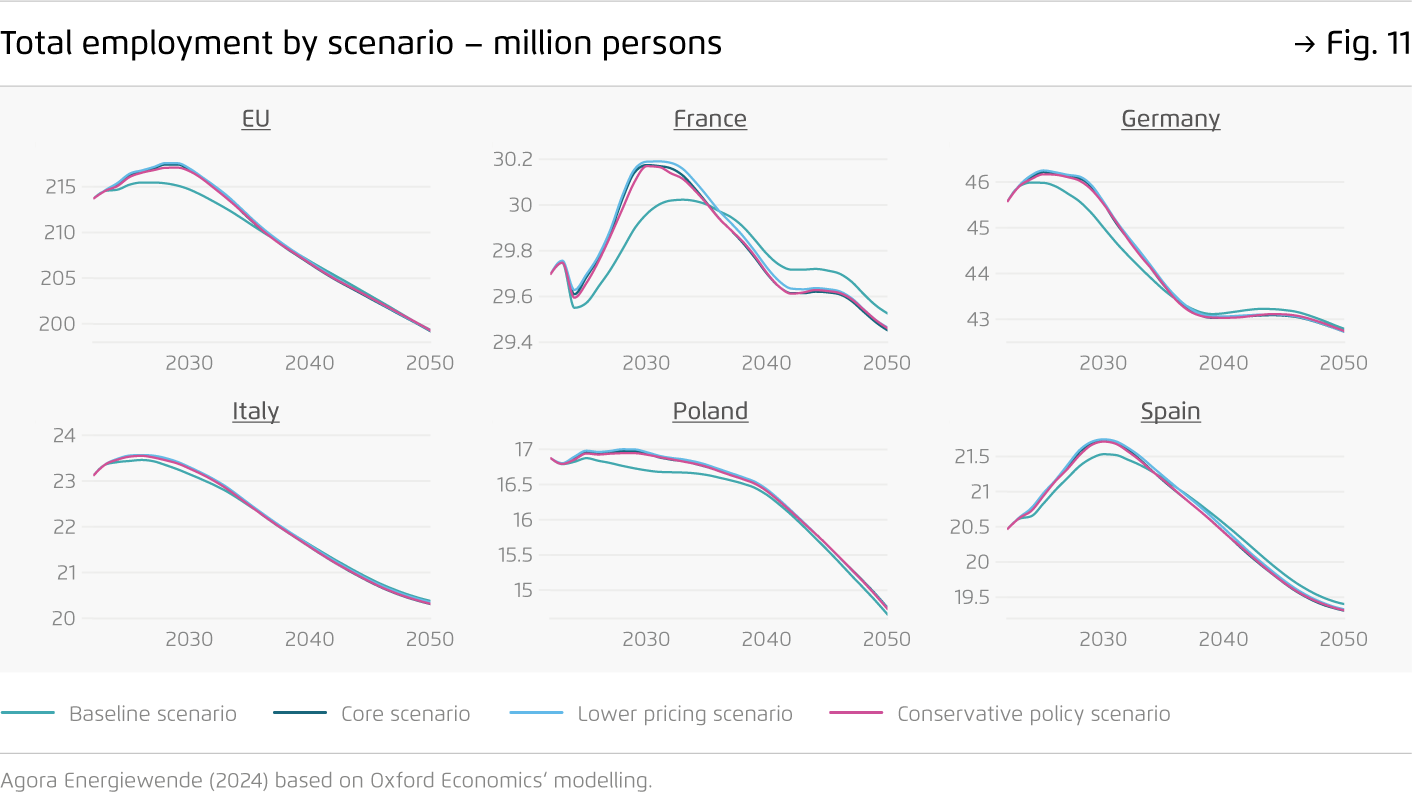

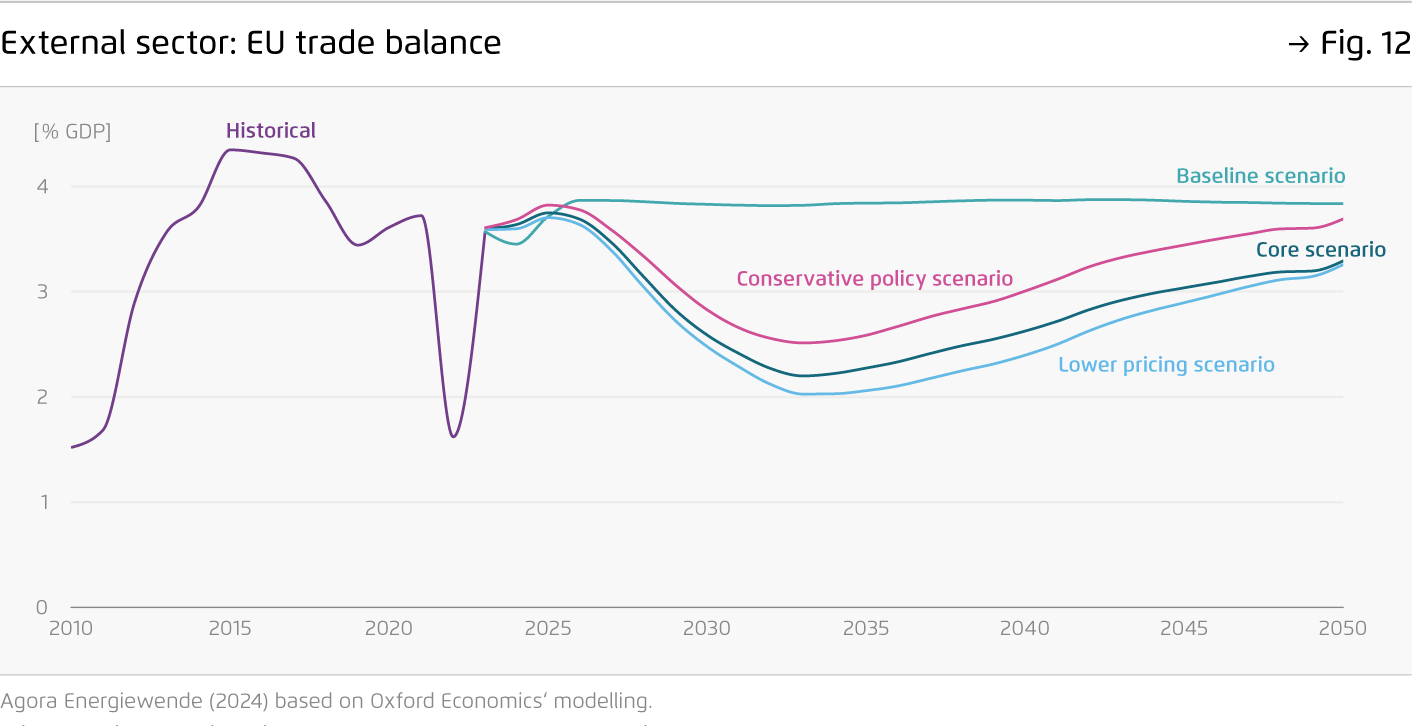

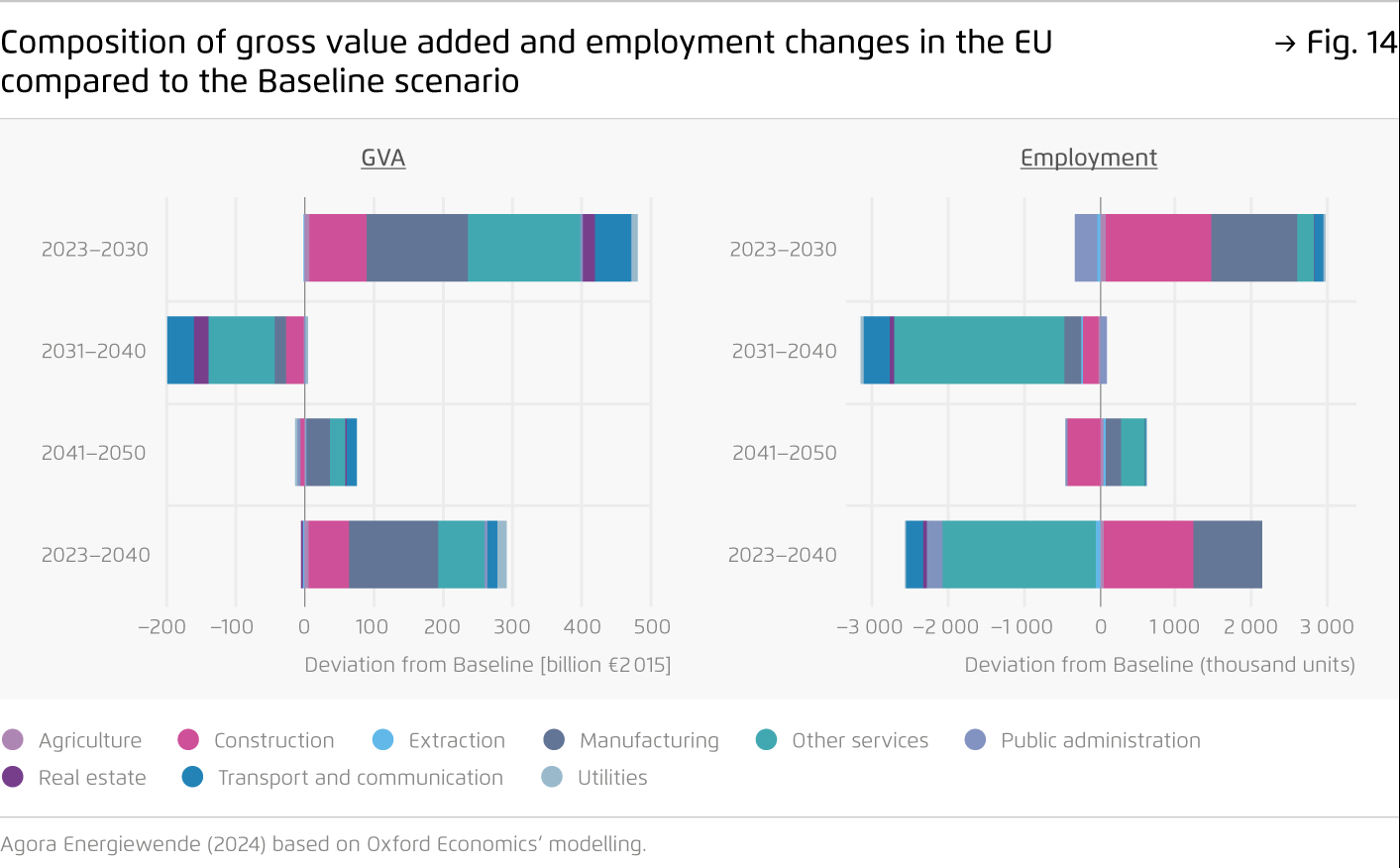

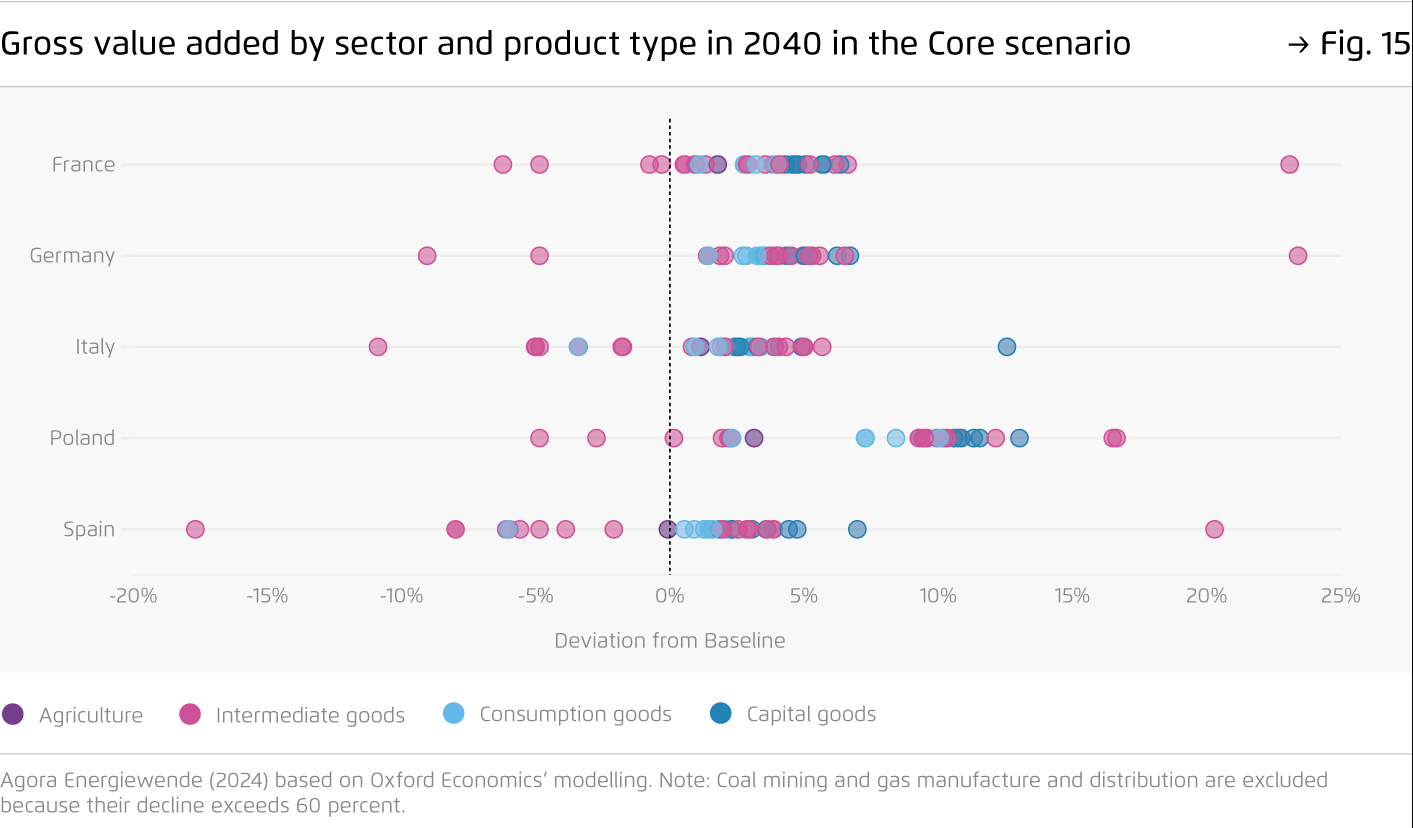

The EU will likely aim for a 90 percent greenhouse gas emission cut by 2040. The related green investments would help increase the EU GDP by around two percent, strengthen demand for EU manufacturing, and foster economic convergence between Western and Eastern Europe. The 2024–2029 EU legislative cycle will be crucial for setting the necessary financial and regulatory conditions for the EU to exploit the positive economic potential of the transition.

-

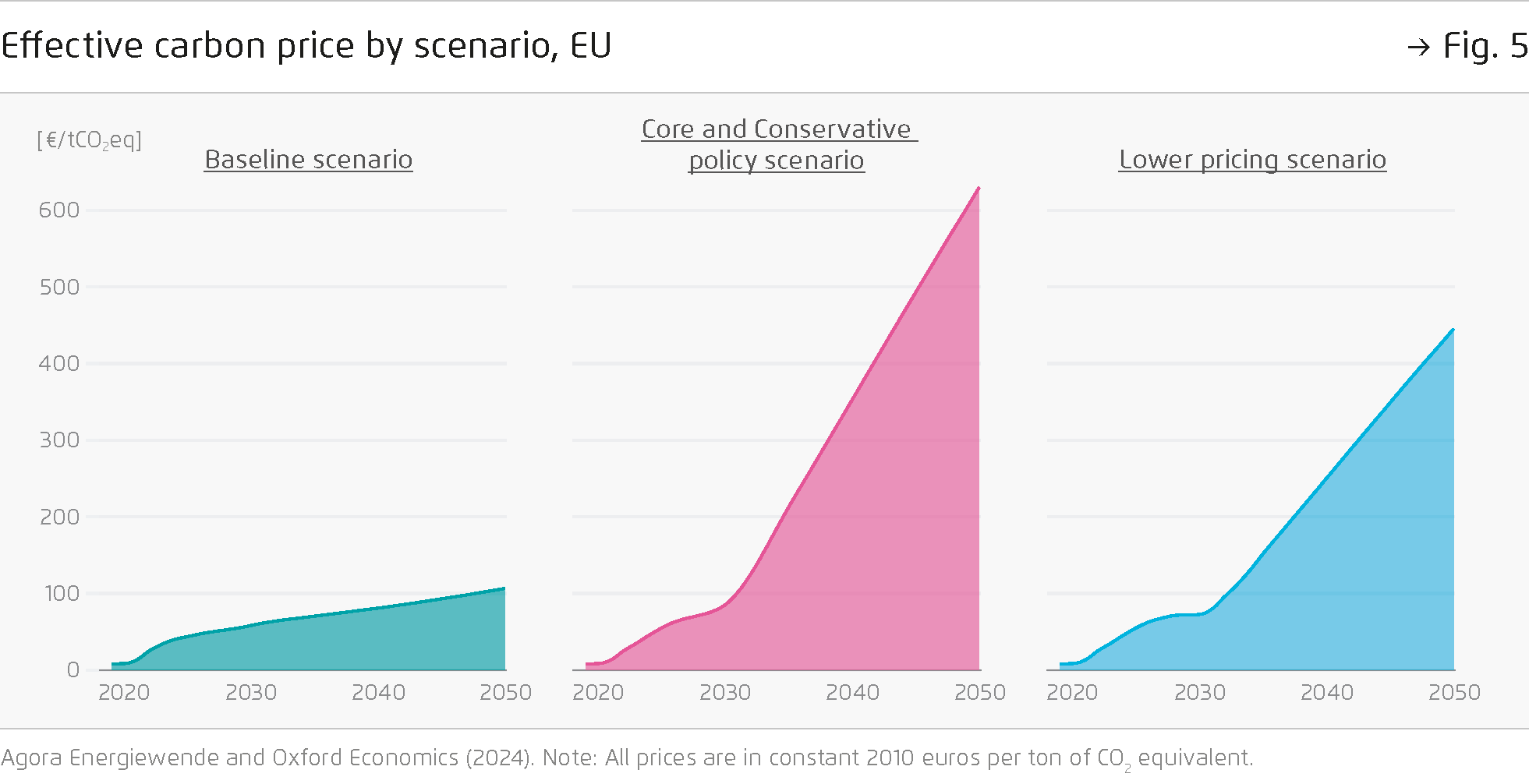

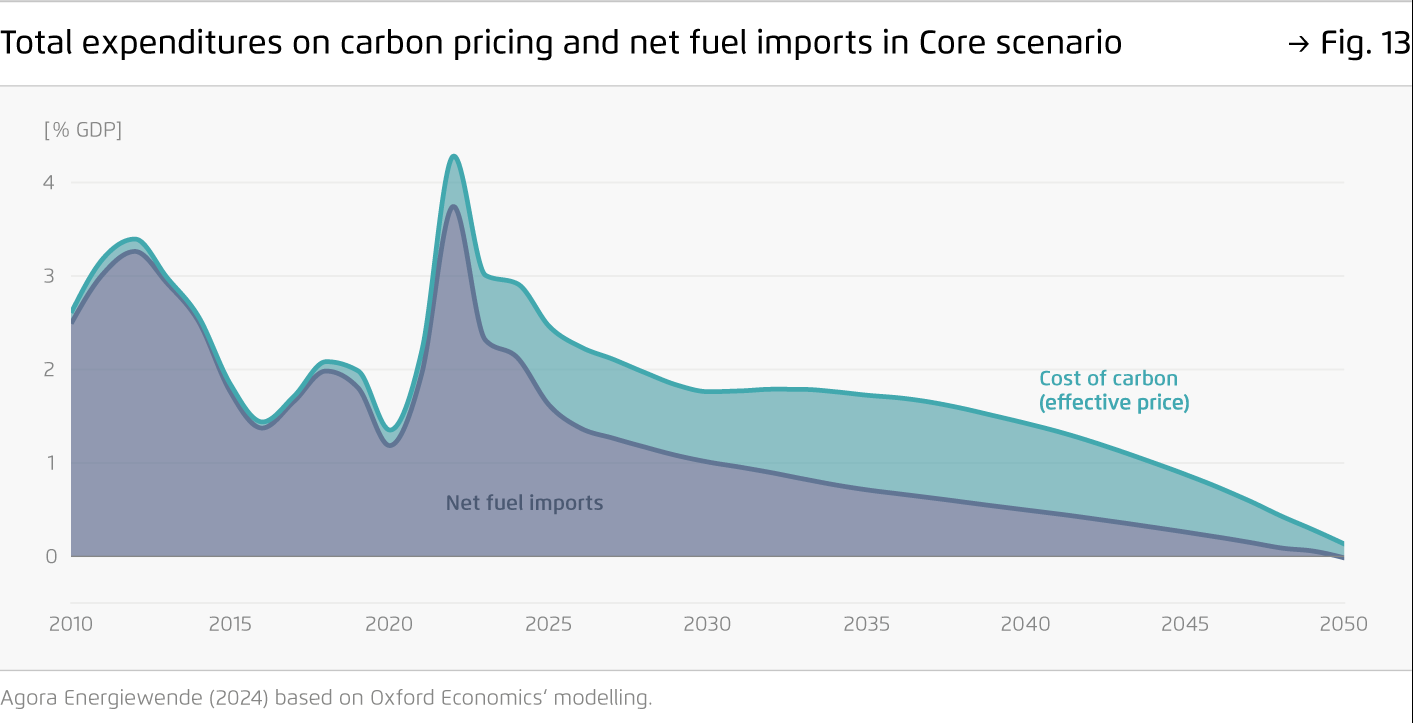

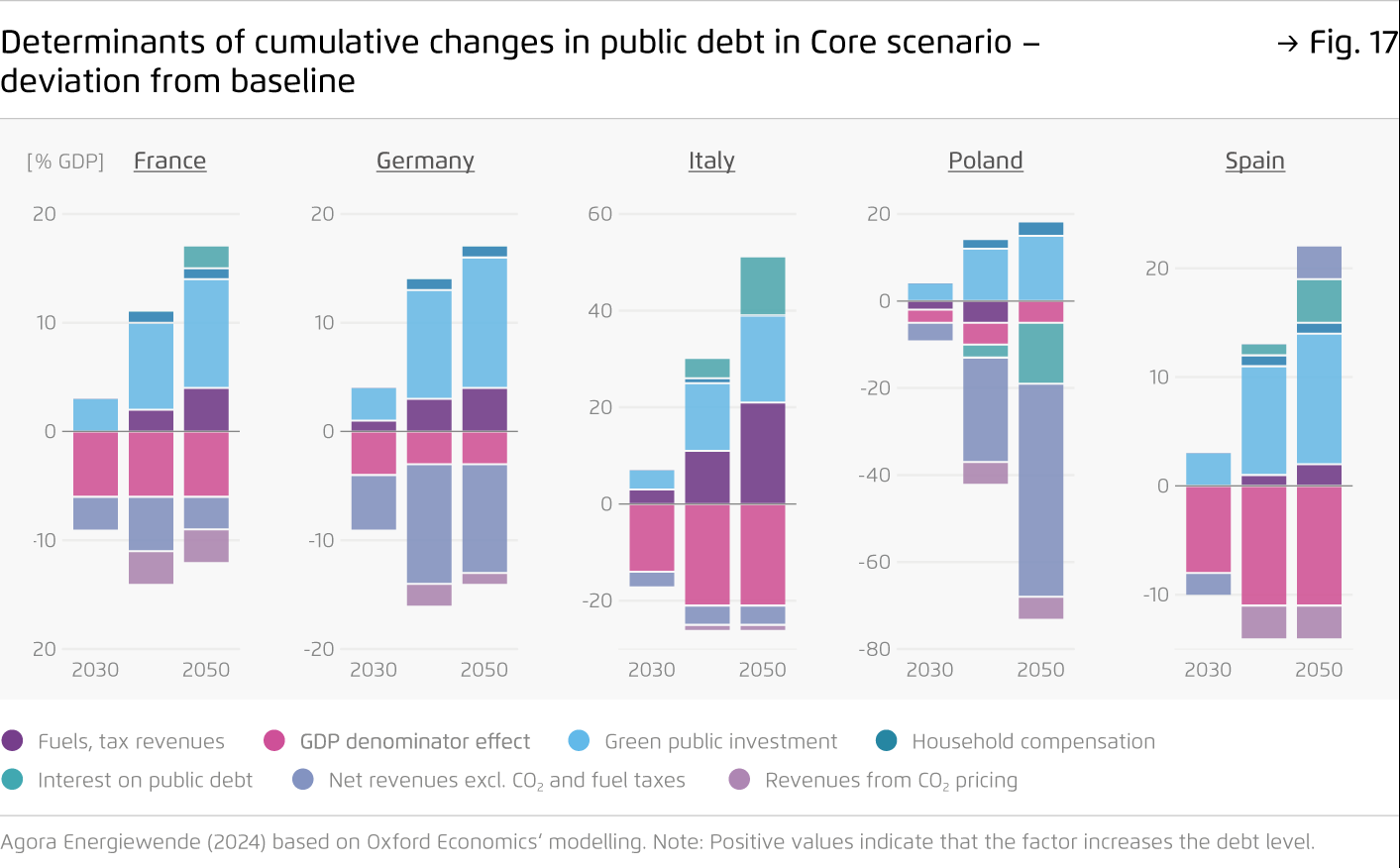

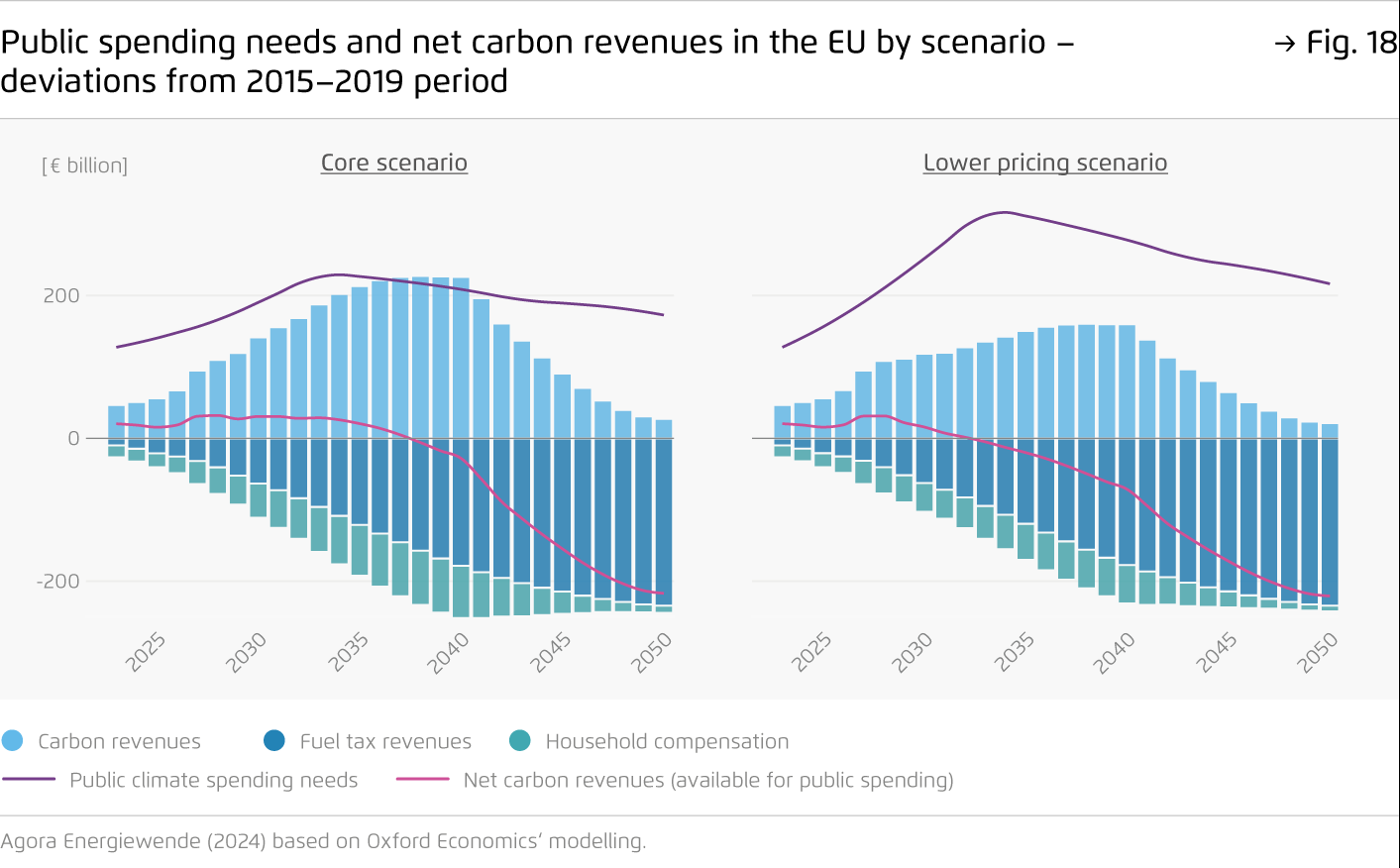

Most EU governments cannot rely on carbon pricing revenues alone to finance their climate investment programmes.

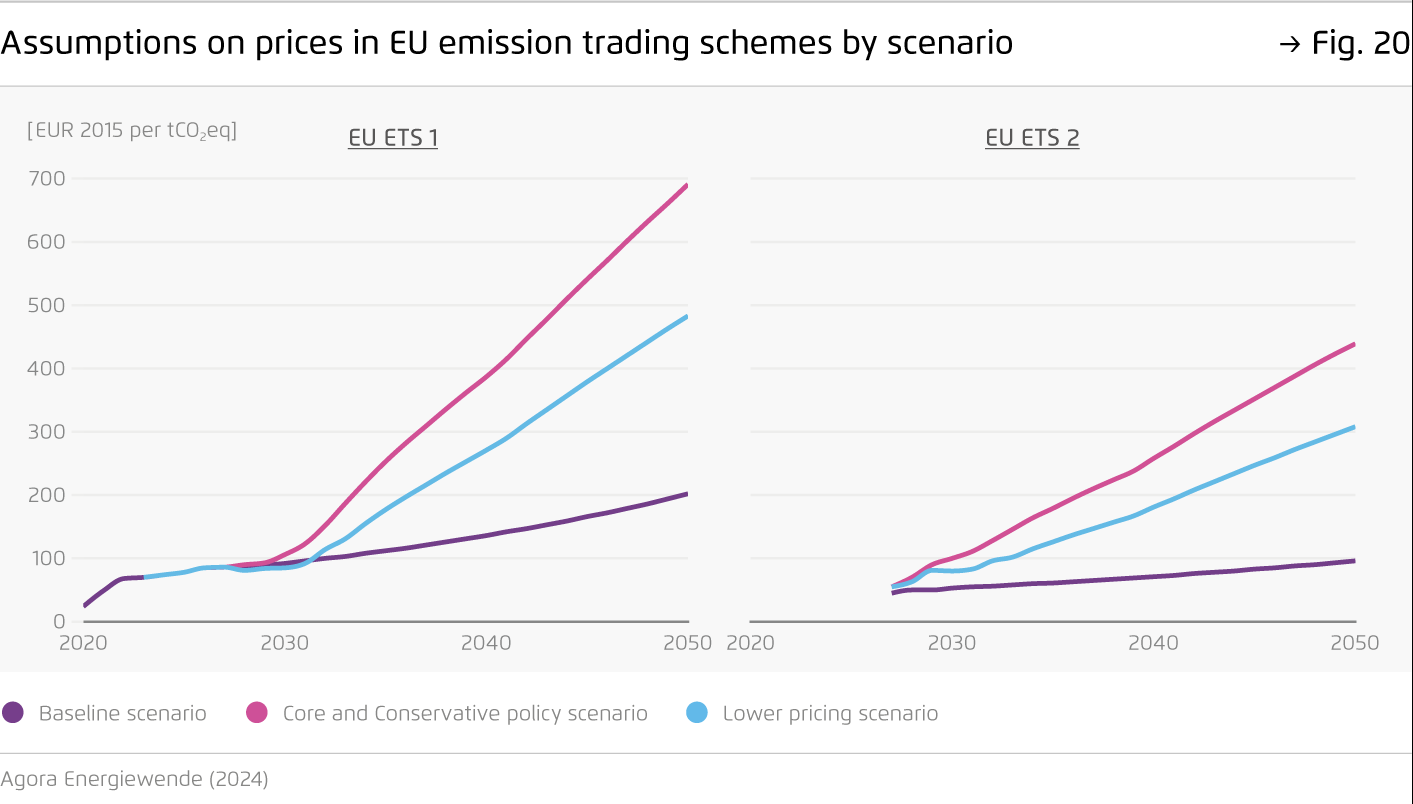

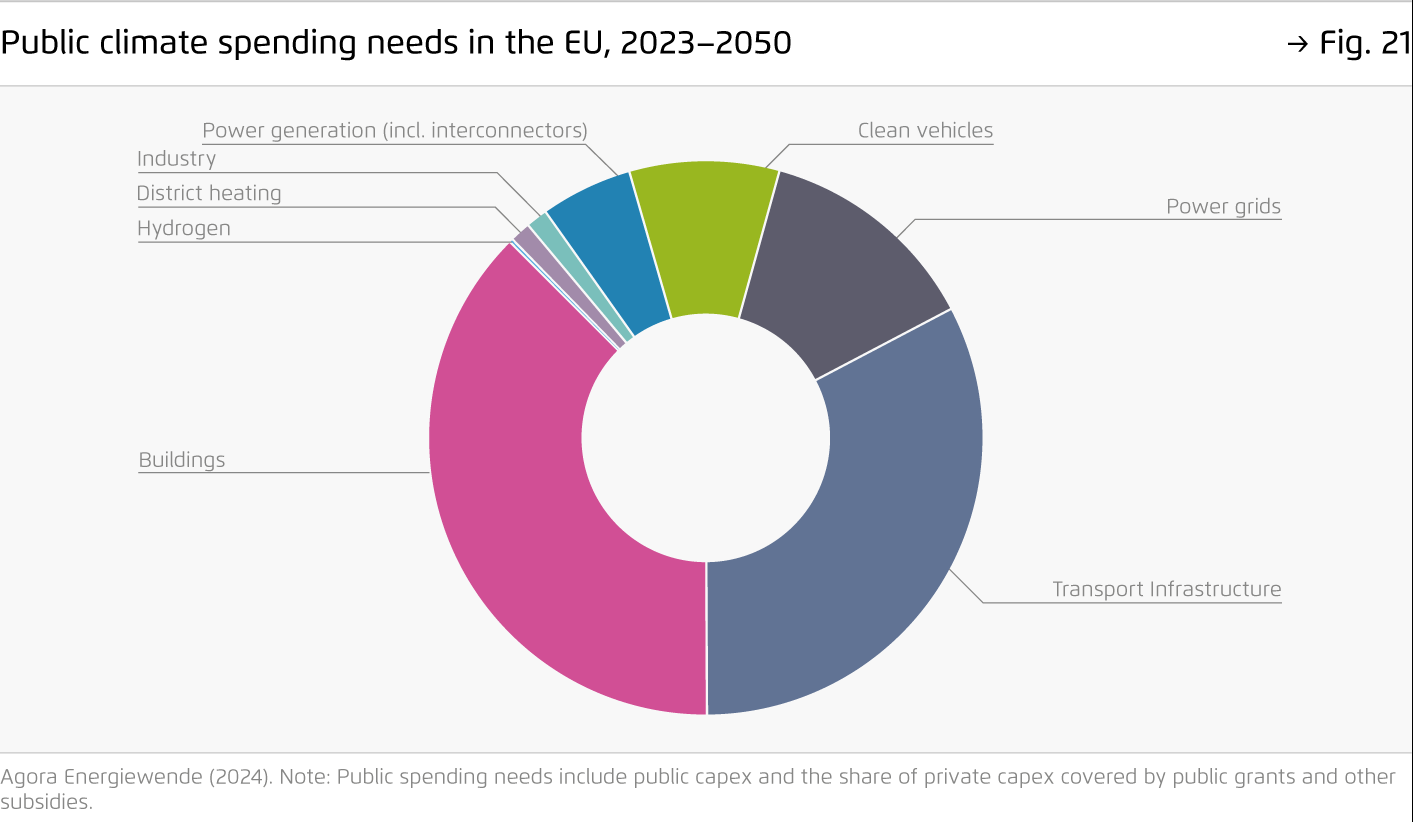

The net amount available to EU governments from carbon pricing is expected to be on average 27.5 billion euros annually from 2030 to 2035. It turns negative after 2037, while EU-wide public spending needs exceed 200 billion euros per year in the 2030s. This finding calls for more flexibility for climate spending in fiscal rules and the examination of new revenue sources to complement carbon pricing.

-

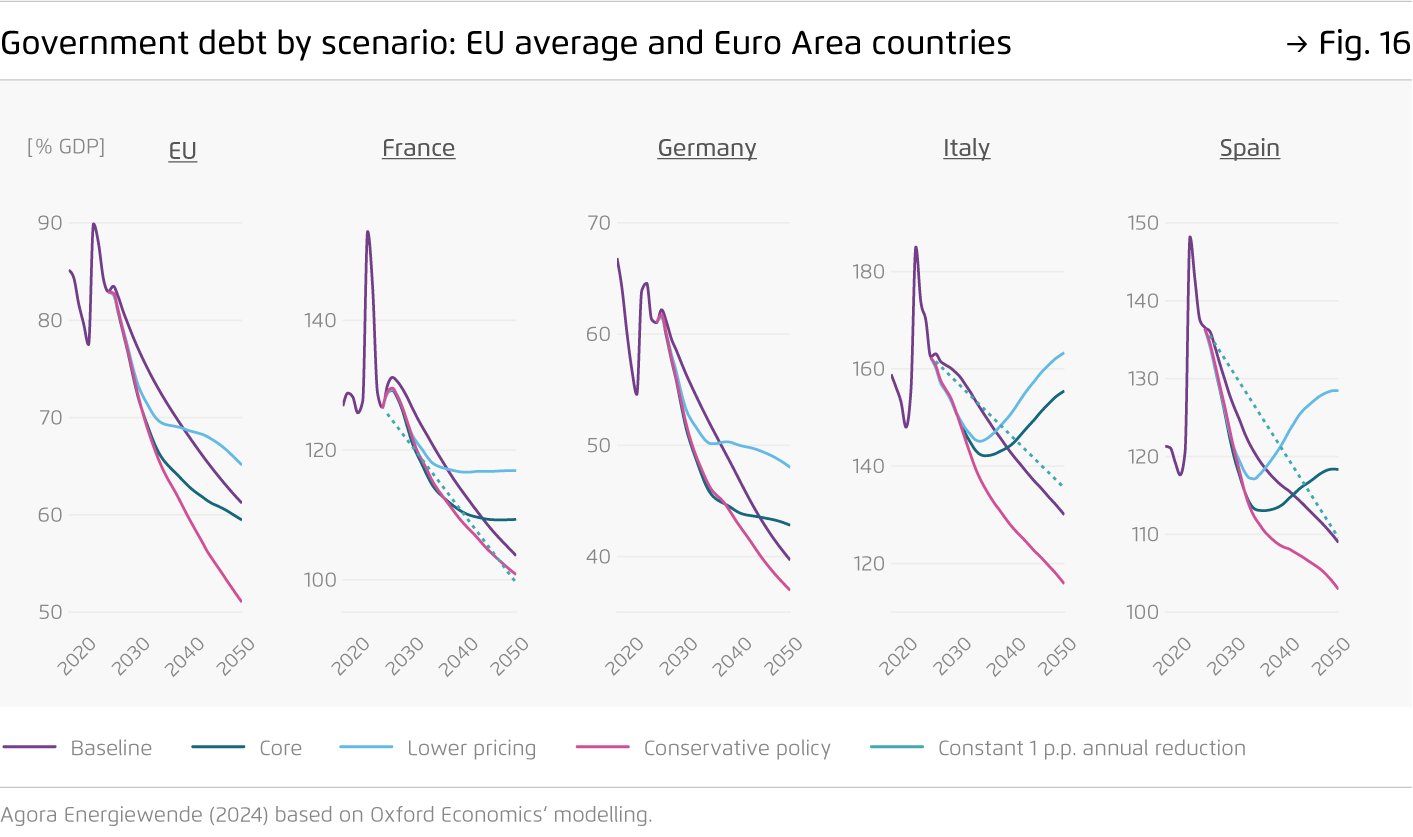

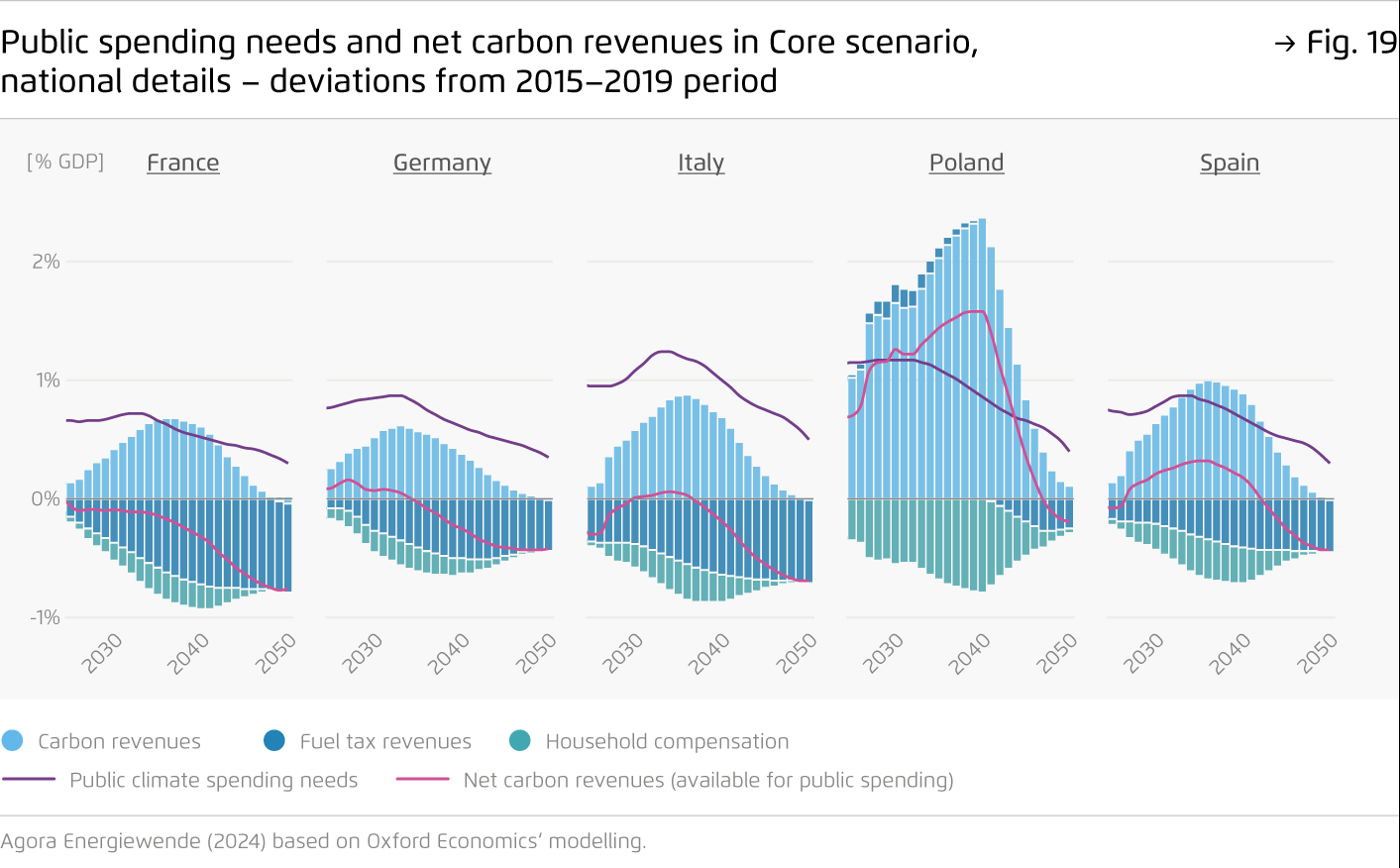

Italy and Spain – among the five countries analysed – will need additional fiscal consolidation for them to deliver both on their climate and debt reduction goals over the long term.

Despite the positive economic effect, these two countries’ debt stocks will tend to build up unless governments carry out additional fiscal adjustments. EU member states should start to assess and address transition-related fiscal risks in debt sustainability analyses and national budget plans.

-

Europe should ensure continued EU-level funding after 2026 when the Recovery and Resilience Facility ends to help safeguard climate action, especially in Southern Europe.

The social and political costs of additional fiscal adjustments pose risks to the implementation of climate policy. EU co-financing would bring substantial benefits for Europe as a whole, as those member states required to cut their public debt stock under the reformed EU fiscal rules account for 40 percent of Europe’s greenhouse gas emissions.

EU climate policy between economic opportunities and fiscal risks

Assessing the macroeconomic impacts of Europe’s transition to climate neutrality

Preface

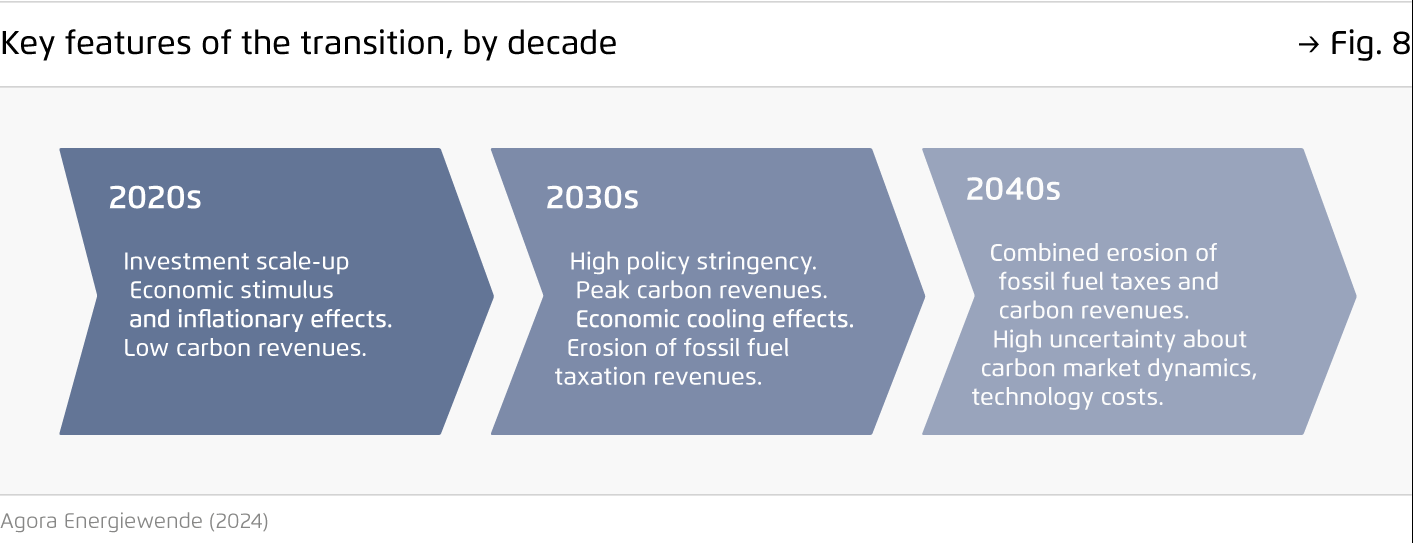

The reforms adopted since 2019 under the European Green Deal initiative will reshape the European economy, while being just part of the regulatory changes that will be needed to reach climate neutrality in the European Union by 2050. Rising carbon prices, stronger regulatory measures and the energy price crunch in 2021–2022 have sparked a broad debate on how Europe’s transition to climate neutrality will affect our standards of living and the distribution of income across Europe.

At the moment, there is a large climate investment gap that Europe needs to close in a challenging geopolitical, fiscal and macroeconomic environment: for the rapid scaling of clean energy infrastructure such as power grids, to make clean heating or mobility solutions affordable to low-income households with little savings or to leverage the private investments into the transition. It is clear that the transition poses a huge challenge to public budgets.

Based on an analysis by Oxford Economics, this report offers new insights on the macroeconomic and fiscal implications of reaching climate neutrality in Europe. We put special emphasis on how national government revenues and debt levels are projected to change as fossil fuels are gradually phased out, and what this implies for the EU economic governance and financial framework.

Key findings

Bibliographical data

Downloads

-

Study

pdf 3 MB

EU climate policy between economic opportunities and fiscal risks

Assessing the macroeconomic impacts of Europe’s transition to climate neutrality

All figures in this publication

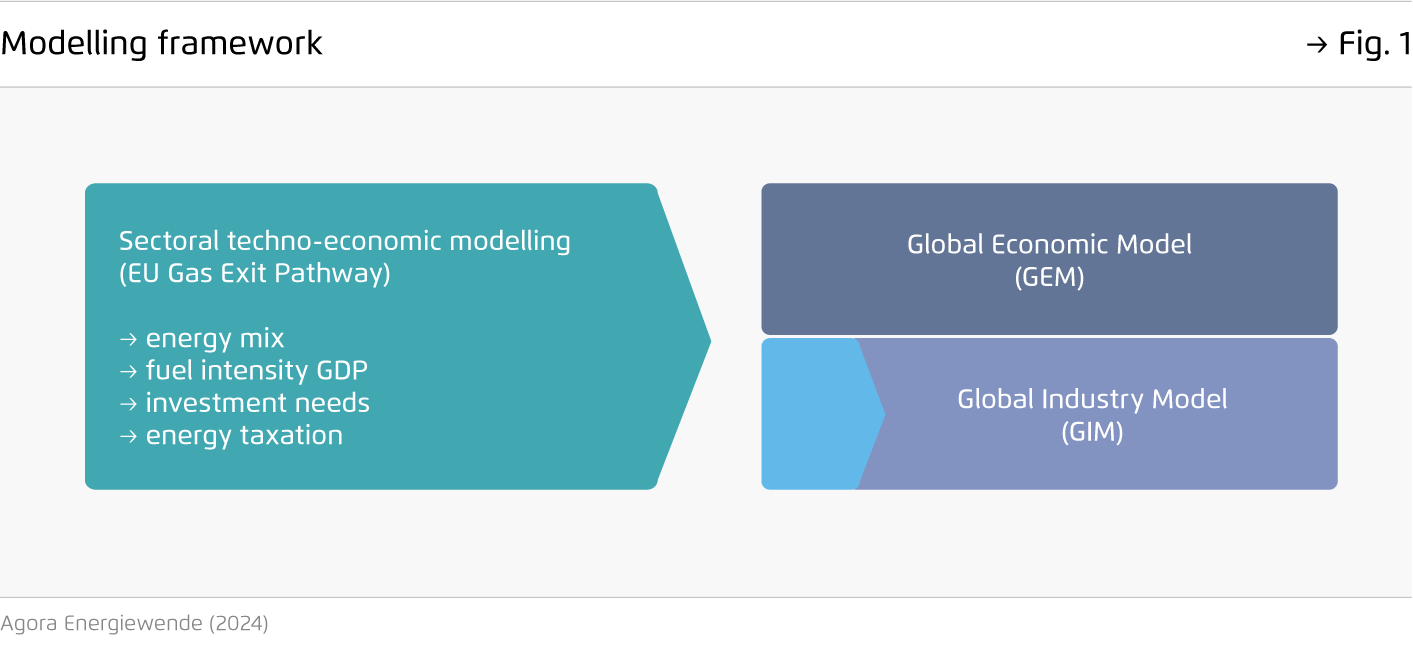

Modelling framework

Figure 1 from EU climate policy between economic opportunities and fiscal risks on page 11

EU Gas Exit Pathway – GHG emissions by sector, EU

Figure 2 from EU climate policy between economic opportunities and fiscal risks on page 12