-

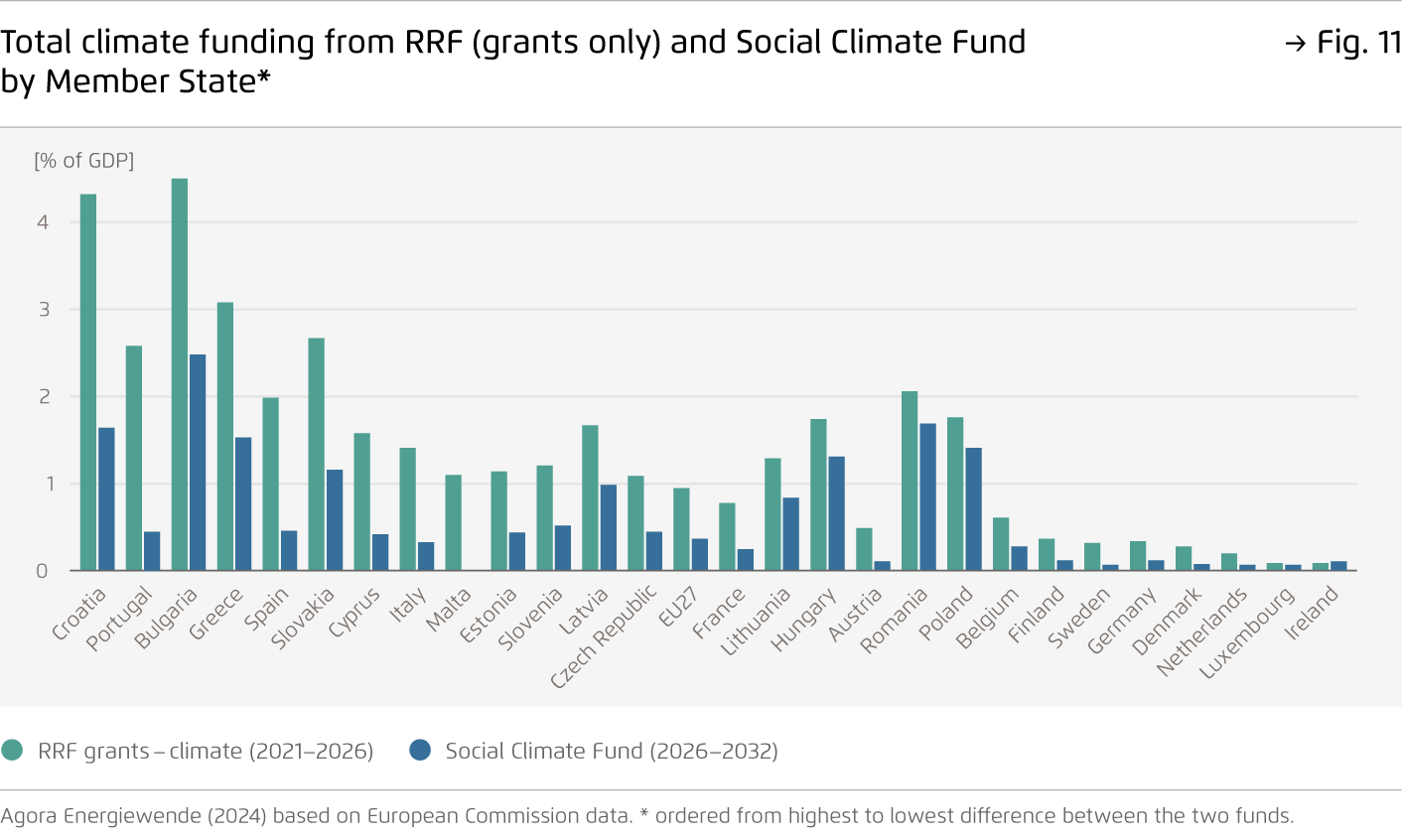

A successful implementation of the EU Green Deal requires addressing the looming climate funding cliff after the EU Recovery and Resilience Facility ends in 2026.

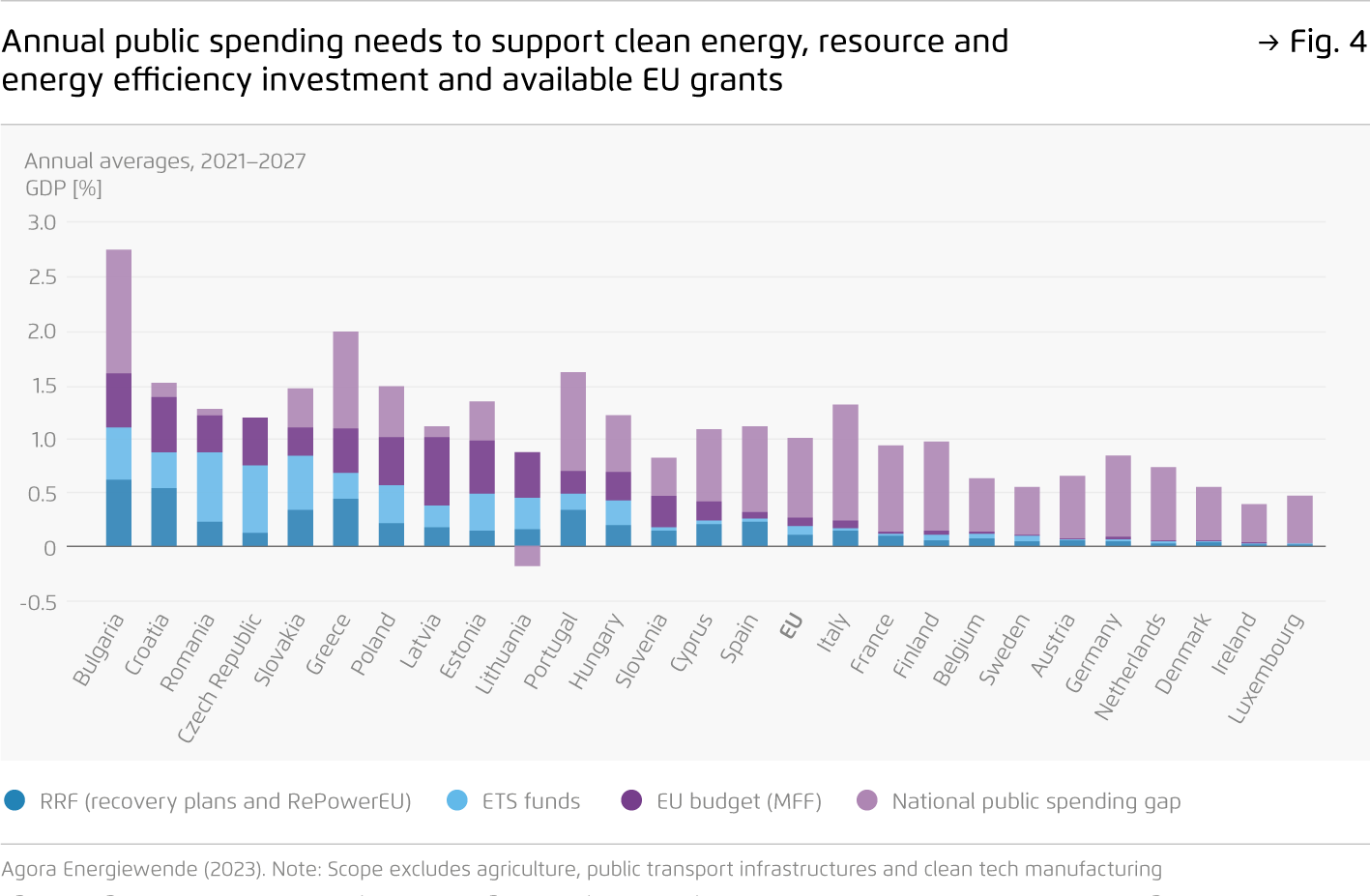

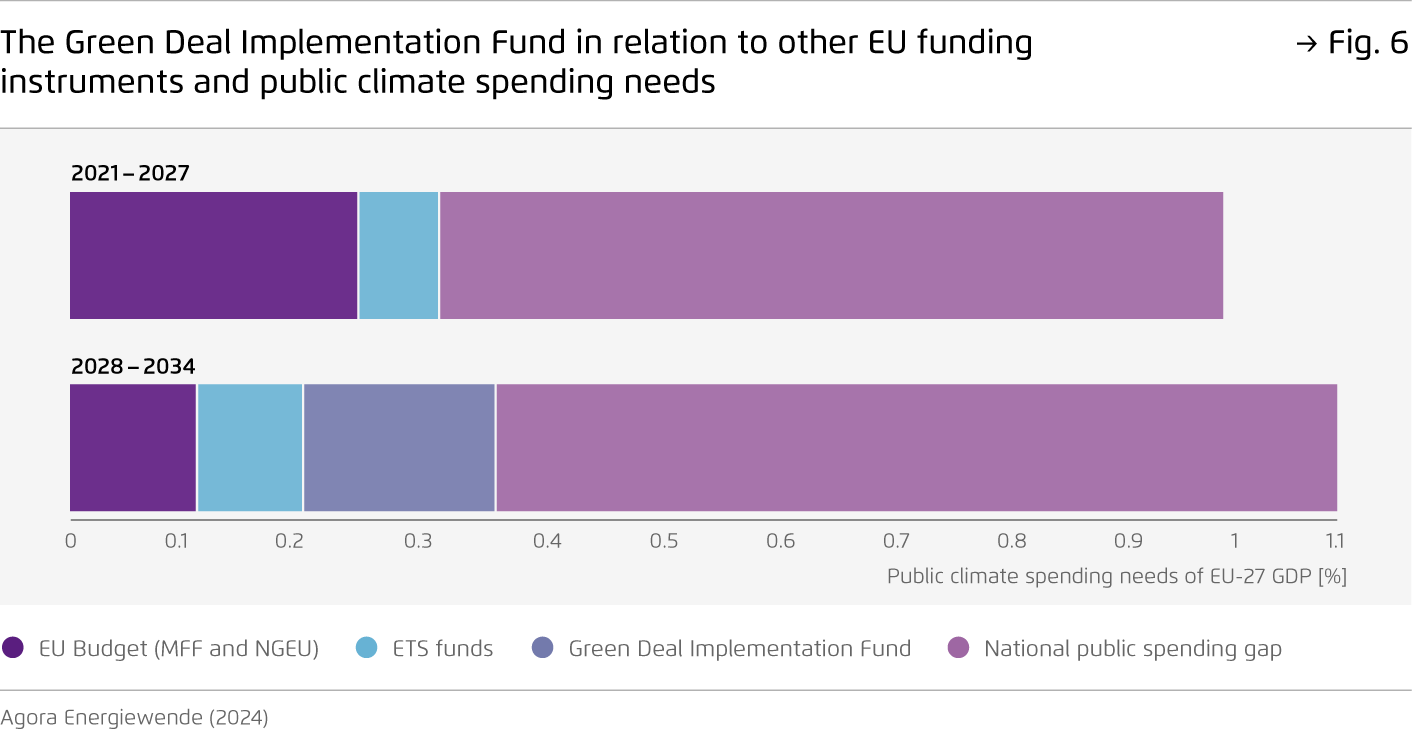

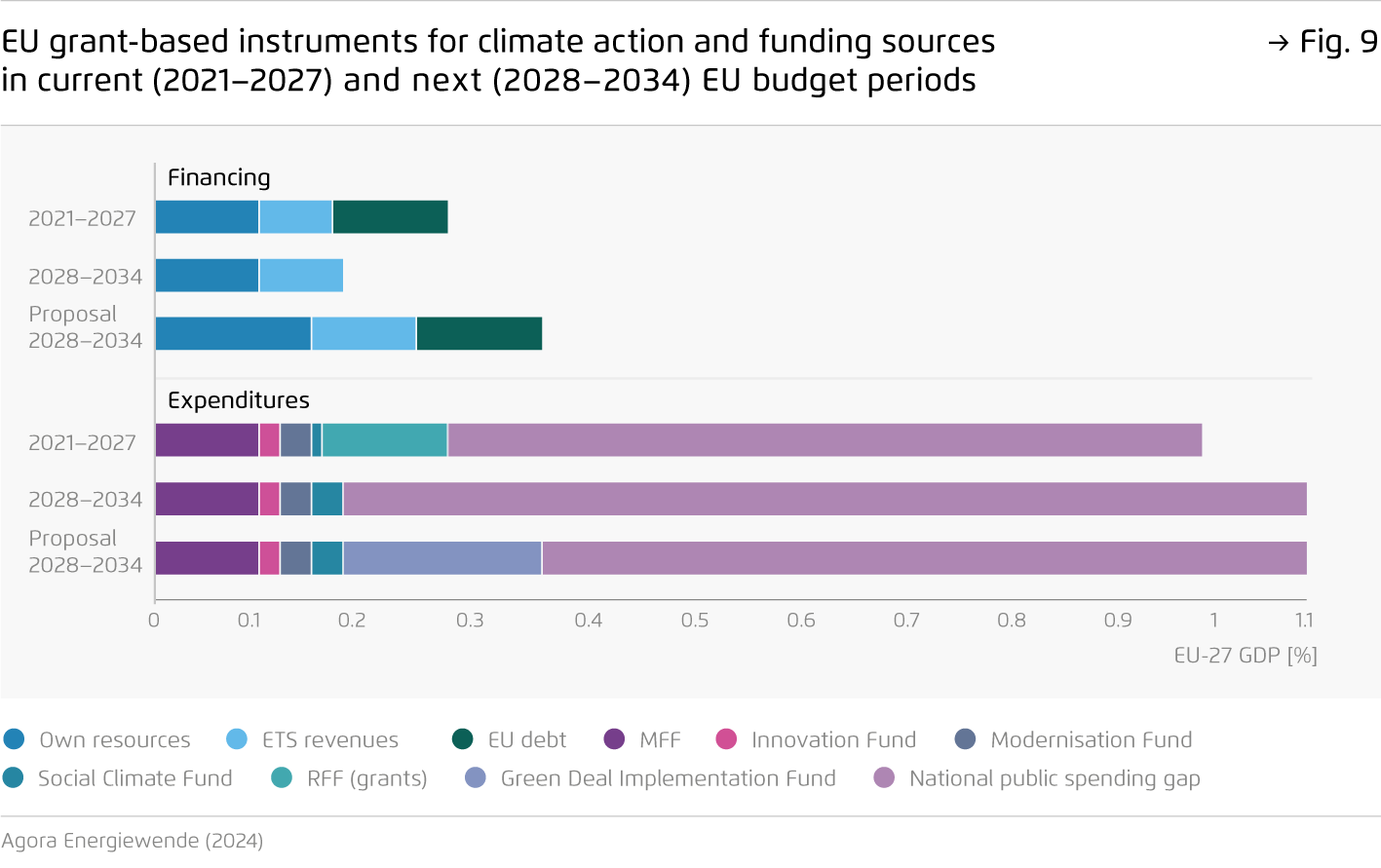

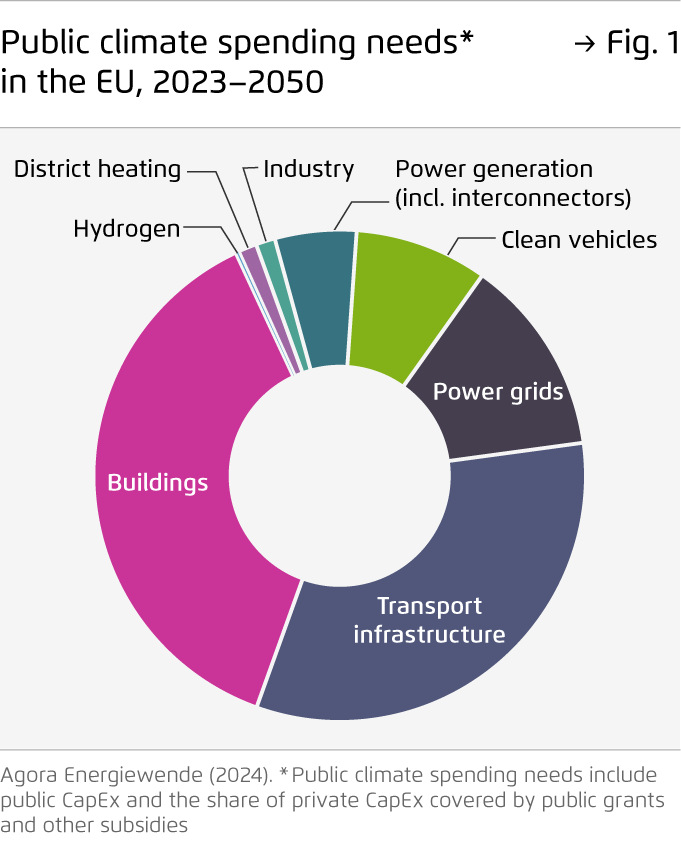

Significant investments – most of them from private sources – will be required to decarbonise buildings, transport and industry, and to build energy infrastructure fit for net zero. Complementary public funding corresponding to around 1.1 percent of EU GDP annually would ensure the necessary investments over this decade.

-

Governments should urgently identify national investment needs and develop financing strategies for implementing the Fit for 55 package.

More clarity about focus and scale of needed investments and the expected contribution of private investments as well as national and EU funding would enhance the impact of EU climate spending.

-

To ensure continuity of funding in the medium term, the EU should establish a dedicated fund to support the implementation of the Green Deal.

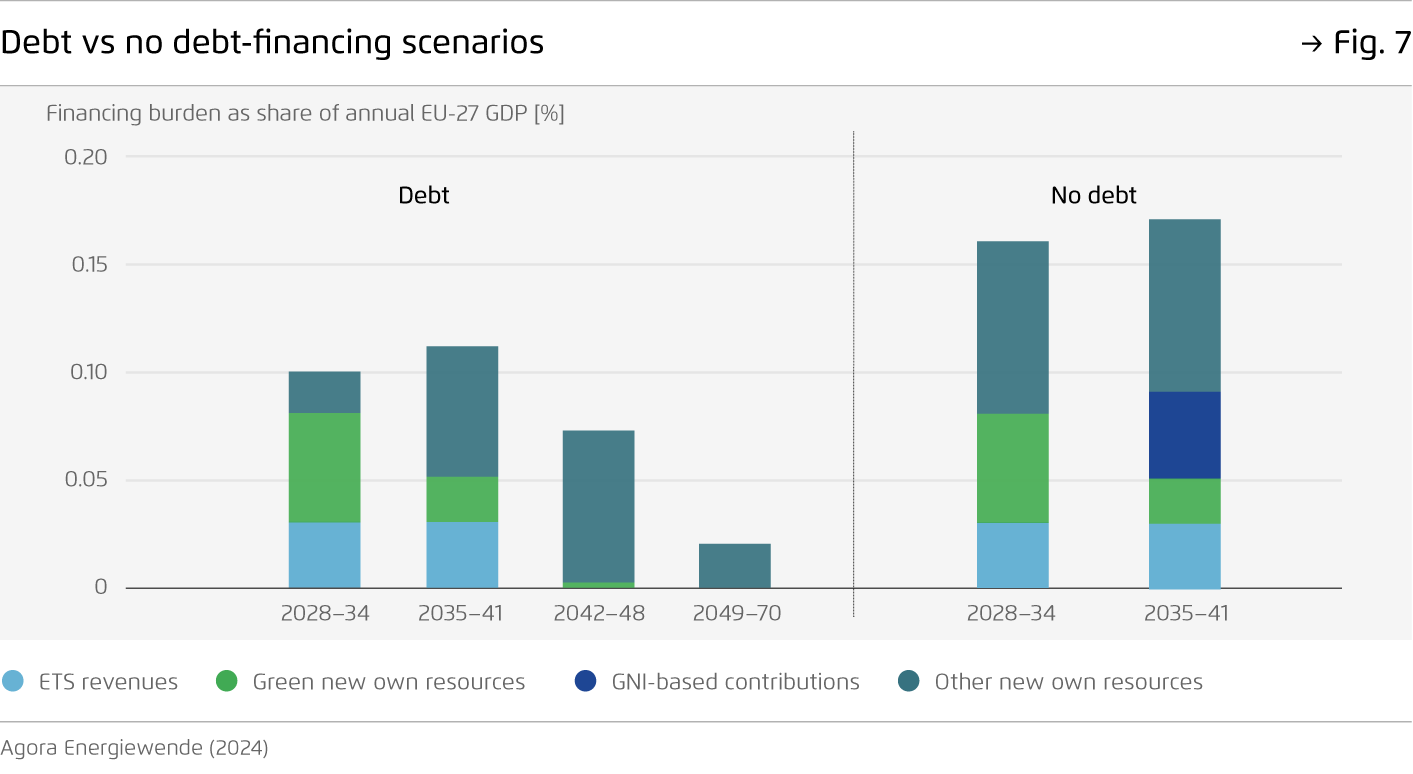

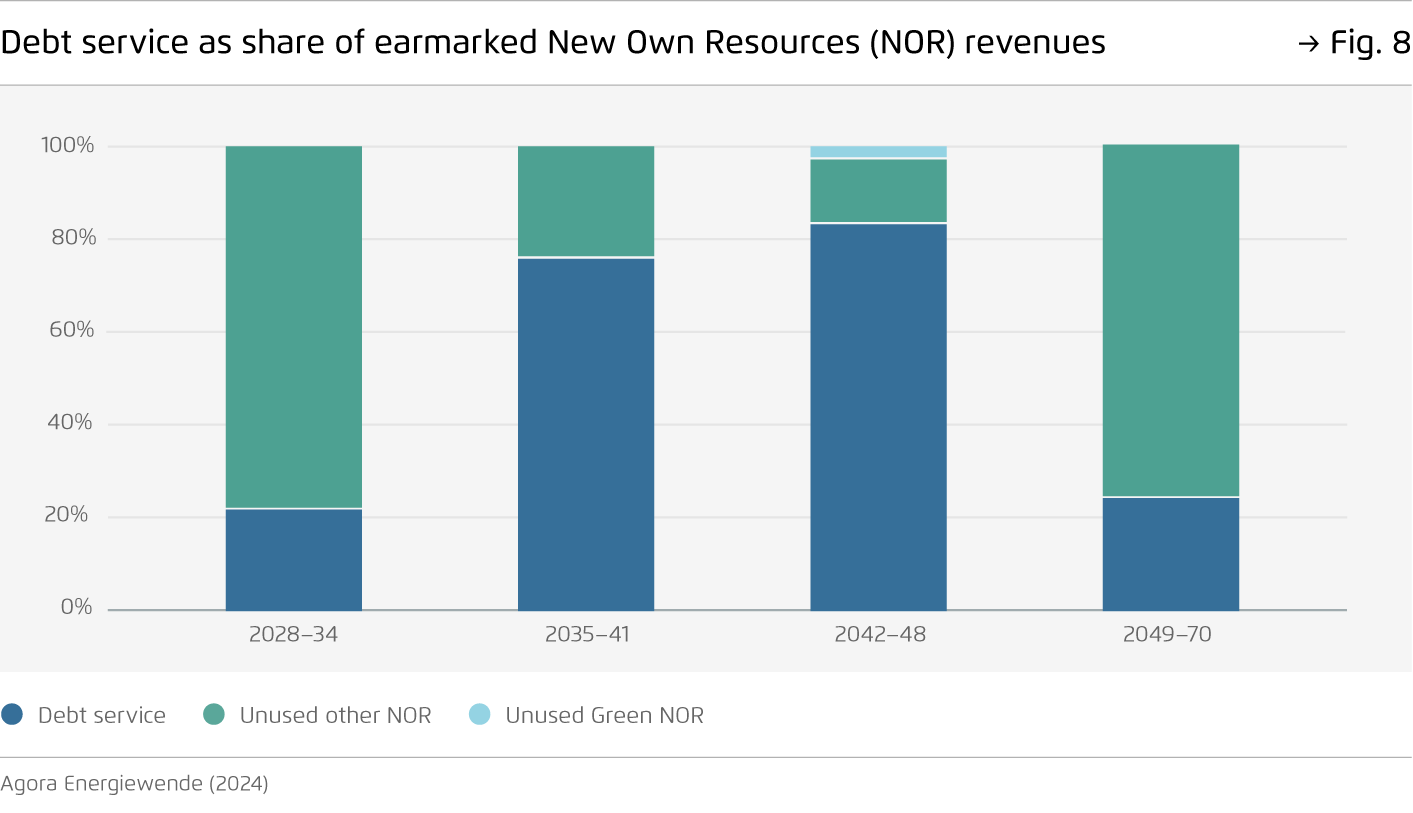

A fund worth 0.17 percent of EU GDP annually, or 260 billion EUR over the 2028–2034 period, would fill the gap left by the Recovery and Resilience Facility. We recommend a mix of new own resources, such as a methane fee or a financial transaction tax, to raise the required finance.

-

InvestEU and future carbon market revenues can help cover short-term funding needs.

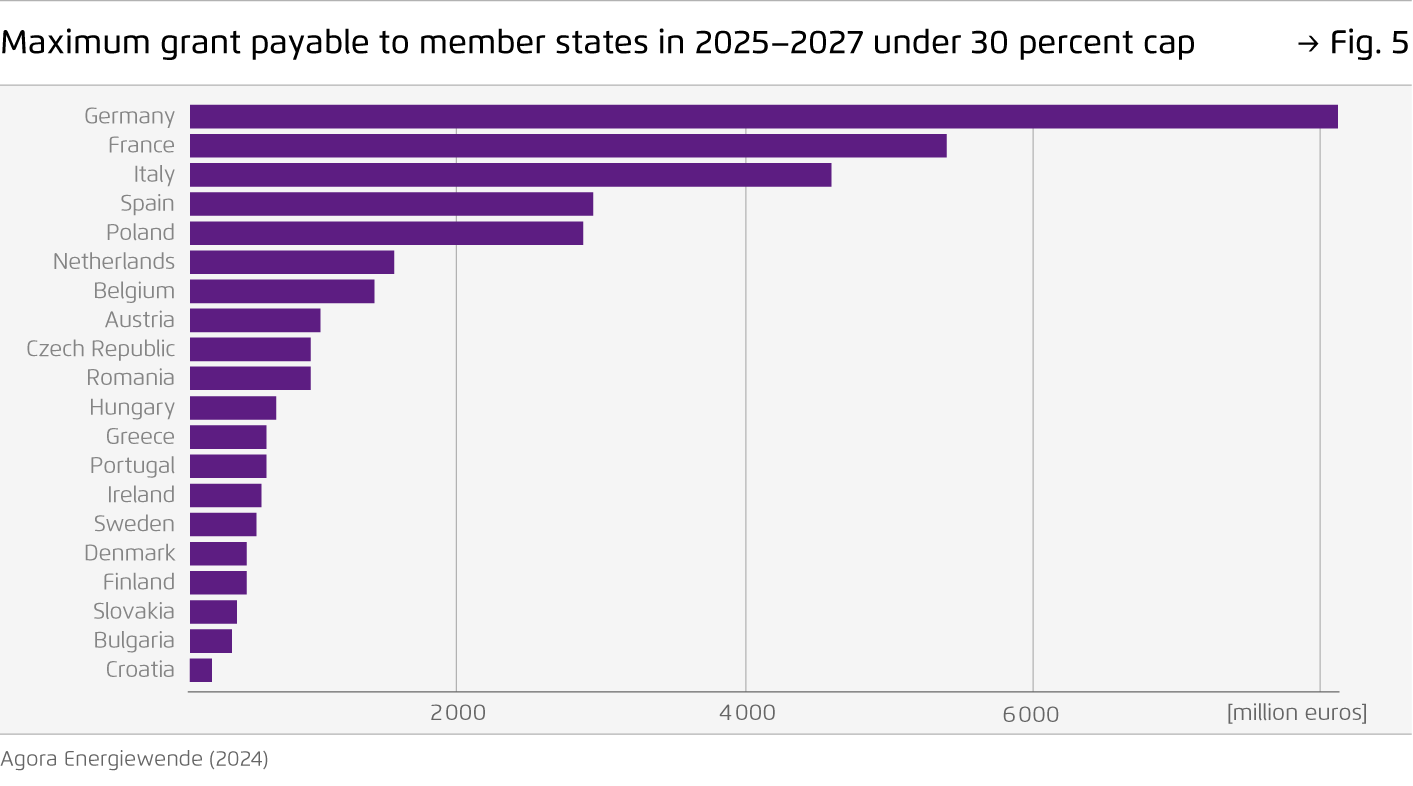

The EU should replenish the InvestEU fund and equip it with guarantees to support the upscaling of smaller-scale cleantech manufacturers. ‘Frontloading’ of expected national carbon pricing revenues from the ETS 2 could provide interested governments with more than 36 billion euros for urgently needed investments in clean heating and transport solutions by 2027.

Investing in the Green Deal

How to increase the impact and ensure continuity of EU climate funding

Preface

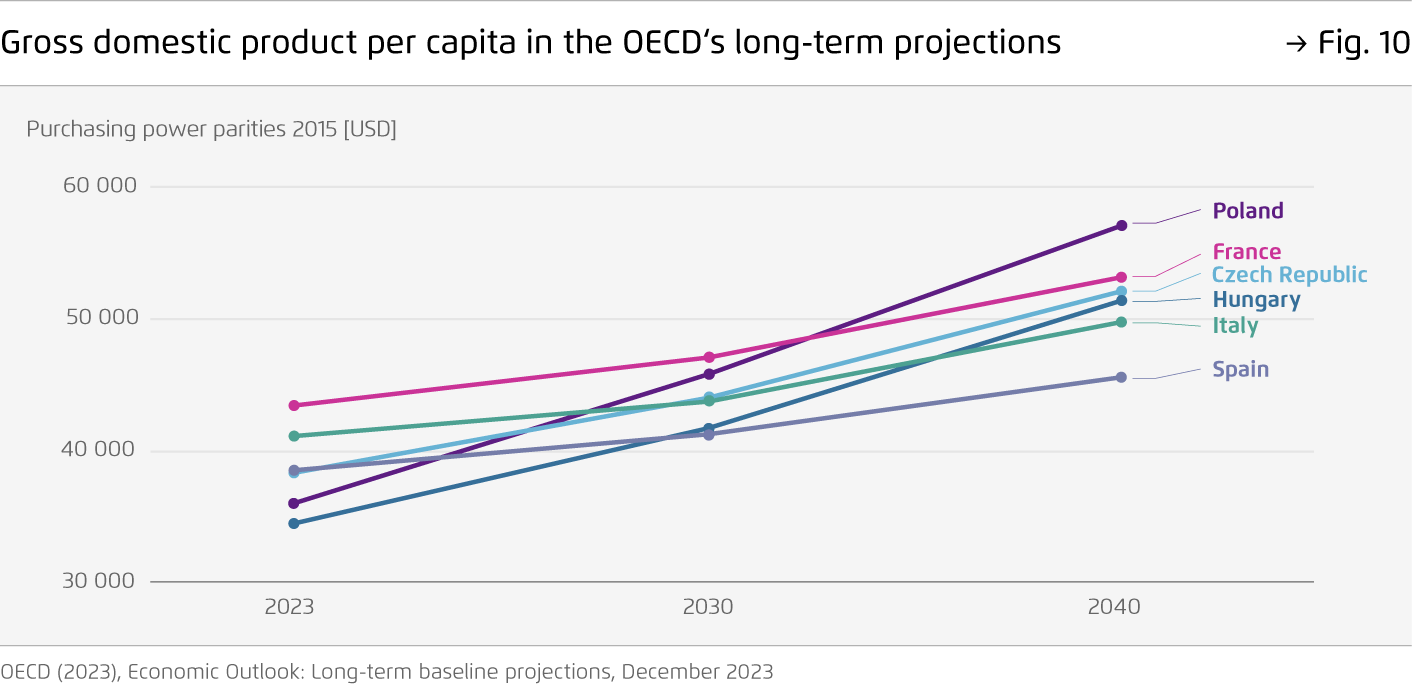

Europe’s transition to climate neutrality requires investments into clean technologies, the transformation of Europe’s industrial base and the build-out of energy infrastructure fit for net zero. At least 2.7 percent of EU GDP of additional investments, or 462 billion euros in 2023 prices will be needed every year throughout this decade.

Most investments will come from private sources, incentivised by a mix of regulation, market signals and enabling measures. However, public funding plays an important role. It facilitates private investments, supports clean energy infrastructure build-out or provides support for lower-income households to switch to climate-friendly technologies.

EU funding constitutes only a small fraction of public spending in Europe, compared with national budgets. Nevertheless, it plays an important role. First, the share of transition-related funding in the EU budget is higher than in national budgets. Second, EU funding can prioritise projects that are particularly important from a continent-wide perspective. Third, it can – to some extent – address distributional concerns that arise from different income levels within the European Union.

The next multi-year EU budget will run from 2028 to 2034 and potential priorities will be discussed from the start of the new policy cycle. In this report, we describe the status quo of EU climate funding, assess upcoming challenges, and offer recommendations to increase the impact and ensure continuity of EU climate funding.

Key findings

Bibliographical data

Downloads

-

pdf 2 MB

Investing in the Green Deal

How to increase the impact and ensure continuity of EU climate funding

All figures in this publication

Public climate spending needs* in the EU, 2023–2050

Figure 1 from Investing in the Green Deal on page 10

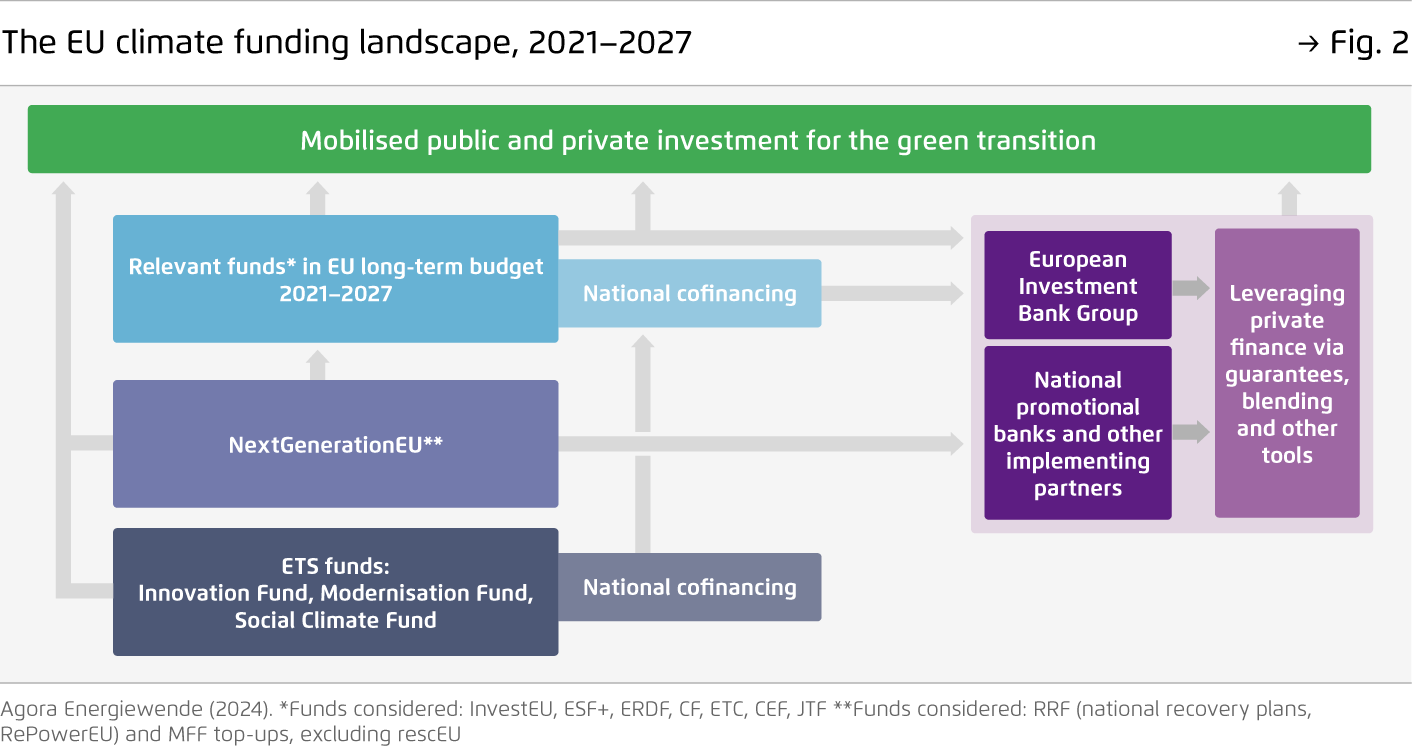

The EU climate funding landscape, 2021–2027

Figure 2 from Investing in the Green Deal on page 14